Delta is a fundamental sensitivity measure in options pricing, quantifying how an option price changes in response to a $1 movement in the underlying asset's price. It plays a critical role in both trading and risk management, offering insights into potential price movements and directional risk.

Definition 1: Delta measures the rate of change in an option's price with respect to a change in the underlying asset's price, keeping other factors constant.

Definition 2: Delta is an amount by which the option's price is expected to change with respect to a $1 change in the underlying asset's price, keeping other factors constant.

As per the definitions,

Option Delta = Δ Option Price / Δ Underlying Price

Example:

Consider the following 1-Day price movements:

Strike Price is $1490.00

Underlying Price changes from $1488.05 to $1498.05

Call Option Premium changes from $8.72 to $14.34

Put Option Premium changes from $10.18 to $5.80

Therefore, using the sensitivity approach,

Call Option Delta = (Ct - Ct-1) / (St - St-1) = (14.34 - 8.72) / (1498.05 - 1488.05) = 0.5620 represents that the price of a call option is expected to change by $0.5620 for every $1 change in the price of the underlying asset, same direction.

Put Option Delta = (Pt - Pt-1) / (St - St-1) = (5.80 - 10.18) / (1498.05 - 1488.05) = -0.4380 represents that the price of a put option is expected to change by -$0.4380 for every $1 change in the price of the underlying asset, opposite direction.

Relationship Between Call and Put Delta

there's a true relationship between call delta and put delta.

It is observed that the sum of absolute values of call delta and put delta equals 1. This relation is prevailing due to the Put-Call Parity theory which states that a protective put is equivalent to a fiduciary call, and therefore, a combination of a long call and a short put is equivalent to a long forward whose delta is equal to 1.

Put Delta = Call Delta - 1

for example,

If the delta of a call option is 0.5620, the delta of a put option is 0.5620 - 1 = -0.4380

It means, that if the price of the underlying asset increases by $1, the price of a call option is expected to increase by $0.5620 and that of a put option to decrease by $0.4380.

Simple right? -- not actually! this relationship will hold good only if the underlying is a non-dividend or non-coupon-paying asset.

Practical Applications: An Estimation Tool or A Risk Sensitivity?

'delta' sensitivity is important because it helps,

traders estimate how changes in the underlying price affect option prices.

risk managers in maintaining delta-neutral positions by adjusting their portfolios accordingly.

The important point to note here is that the option sensitivities are in terms of a unit change in a single risk factor, while keeping other risk factors constant, unlike elasticity (stated in terms of percentage change in one factor), scenarios, or simulation (simultaneous change in multiple risk factors).

Sophisticated Estimation: Black-Scholes-Merton (BSM) Model

In professional trading, delta is estimated using advanced pricing models like the Black-Scholes-Merton (BSM) model, which defines delta as the probability of an option expiring in the money (ITM).

As discussed earlier, traders use the option's delta to predict changes in the option's price due to changes in the price of the underlying asset.

Mathematically,

If the price of an underlying asset increases, the option delta of both call and put options increases too. However, the price of the Call Option increases, and that of the Put Option decreases.

If the price of an underlying asset decreases, the delta of both the call option and put option decreases too. However, the price of the call option decreases, and that of the put option increases.

And because of this relationship, the delta of a call option always remains positive (it will range between 0 and 1, representing a positive relationship with the underlying) and the delta of a put option always remains negative (ranging between -1 to 0, representing a negative relationship with the underlying). This ranging variable (ie., option's delta) may change depending upon the Moneyness of an Option as far as we look into the direction of the underlying asset. However, it may also change due to the change in the volatility and time-decay, but that is the next topic of our financial book.

The formula that has been stated above with an example is a sensitivity-based formula that strictly goes with explanations 1 and 2. However, professional traders determine the price of an option using some sophisticated models that often resemble the Black-Scholes-Merton (BSM) model. This model provides a mathematical function to estimate the theoretical price of an option by considering market risk factors.

Definition 3: An option's delta is the probability that determines the expected payoff in case the option expires in the money.

As per the pricing function provided by the Black-Scholes-Merton (BSM) Model,

C(0) = St * N(d1) - K*e^-rt * N(d2)

Here, N(d1) is the probability that helps in determining the expected payoff in case the option is getting exercised (or expires in the money). As per explanation 3, N(d1) is called the option's delta. The formula to arrive at this is actually provided by Black and Scholes in their pricing model.

N(d1) = [ (LN(St/K) + (r-q+σ^2/2)*T) / σ*√T ] from the standard normal distribution

Practical Example:

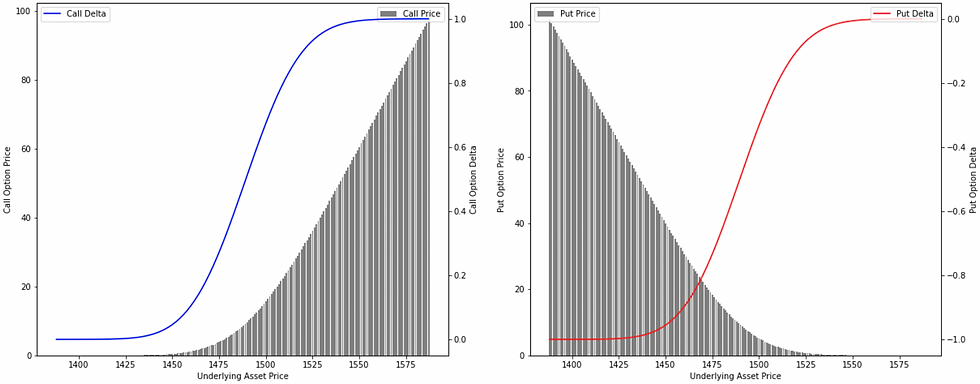

[option's delta series across the spot ladder at a particular strike price]

Using the Black-Scholes equation,

[ (LN(1488.05/1490.00) + (0.06-0+0.2145^2/2)*0.0055) / 0.2145*√0.0055 ] from the standard normal distribution.

N(d1) = 0.4785

The below table represents option delta values and prices across the movement in the price of the underlying asset. This can be calculated with the help of the above equation.

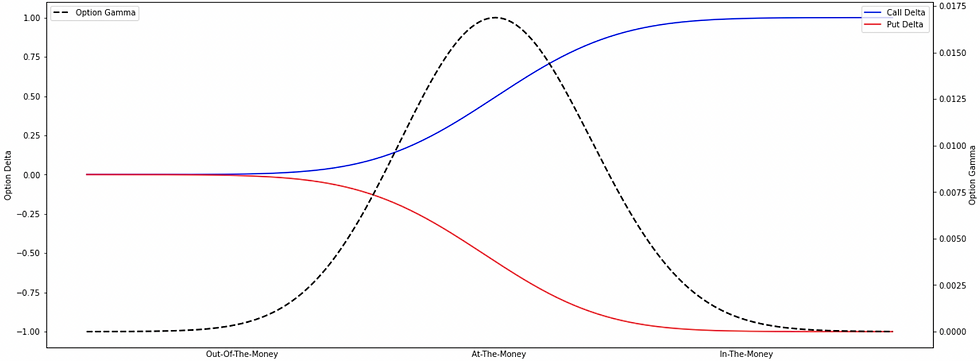

Observation 1: Considering an ATM option, the probability of the option landing ITM is 50%, and therefore, the delta of an ATM call option remains close to 0.5 and that of an ATM put option -0.5.

As the price of the underlying asset increases (from ATM to ITM to deep ITM i.e. from $1488.05 to $1498.05 to $1508.05), the delta of the call option also increases (from 0.4785 to 0.6435 to 0.7843). As the option gets further ITM, the probability that the option will land ITM increases, and therefore, the call option's delta also increases. This makes the deep ITM options more attractive as the probability of their getting exercised is high, and therefore, the delta of a deep ITM call option is also high.

As the price of the underlying asset decreases (from ATM to OTM to deep OTM i.e. from $1488.05 to $1478.05 to $1468.05), the delta of the call option also decreases (from 0.4785 to 0.3162 to 0.1825). As the option gets further OTM, the probability that the option will land ITM decreases, and therefore, the call option's delta also decreases. This makes the deep OTM options less attractive as the probability of their getting exercised is low, and therefore, the delta of a deep OTM call option is also low.

Observation 2: Considering the near ATM options (price range of $1458.05 to $1518.05), the option's delta curves are steeper than that of the deep ITM and OTM options.

(expanding the coverage of near ATM options)

This is because of the fact that the near ATM options are more sensitive to the change in the price of the underlying asset as these options have a nearly 50% probability of them getting exercised and a near 50% probability of them getting lapsed. This creates uncertainty in the minds of the traders leading to a higher number of buy-sell positions resulting in higher variability in the option's delta as shown above.

Observation 3: Considering the other options trading deep ITM or OTM has a greater probability of them getting exercised or lapsed, respectively, as a small change in the price of the underlying asset won't be impacting much on the probability, and therefore, the delta value remains reasonably stable.

This is the main reason why the option's Gamma i.e. the second-order derivative is comparatively higher for near ATM options and lower for ITM and OTM options.

Why Delta is Critical for Risk Managers And Professional Traders?

Delta (first-order sensitivity) reflects an option's price changes relative to a $1 movement in the underlying asset's price. In simple terms, it's your directional exposure to the underlying asset.

Professional traders are more interested in monitoring option chains and analyzing delta across multiple strike prices and expires to evaluate market sentiments and risk exposure.

having both option prices and their corresponding Greeks across strike prices helps them,

estimate any potential change in risk exposures, and identify factors impacting their positions.

adjust their positions by buying or selling options to maintain desired delta exposure or achieve delta-neutrality.

As a trader, Delta is not just a number—it’s the heartbeat of your option position. Professional traders are more interested in monitoring option chains and analyzing delta across multiple strike prices and expires to evaluate market sentiments and risk exposure.

Practical Example:

A trader holds a portfolio of call options with a total Delta of 0.5620 and expects the underlying asset's price to rise by $10. Using Delta:

Change in Portfolio Value = Delta (Δ) x Change in Asset Price = 0.5620 x $10 = $5.620

this calculation helps forecast a $6 gain, enabling the trader to prepare for adjustments. It helps,

estimate any potential change in risk exposures, and identify factors impacting their positions.

adjust their positions by buying or selling options to maintain desired delta exposure or achieve delta-neutrality.

When you hold an option, Delta isn’t just about how much the option price will change—it’s also about how you weigh the probability of success. A Delta of 0.7 doesn’t just mean your call option will gain $0.70 for every $1 move in the underlying. It means you have a 70% chance of expiring In-the-Money (ITM). Are you leveraging this insight, or are you leaving it on the table?

Being Delta-neutral doesn’t mean you’re risk-free. Gamma can surprise you, especially when the market moves quickly. Are you prepared for the Gamma impact, or are you focused only on the immediate Delta balance?

Delta changes with price, time, and volatility. Are you adjusting your positions dynamically, or are you assuming yesterday’s Delta is still working for today’s market?

Delta lets you decide whether you want to play the market’s momentum or hedge against it. Are you using Delta to express your conviction or to protect your capital?

Delta is the cornerstone of Delta-neutral strategies, where traders balance directional exposure by offsetting Delta through a mix of options and the underlying asset or can neutralize directional risks or tailor their risk exposure to specific scenarios with precision. As a trader, your edge lies in not just knowing Delta but anticipating its evolution.

Whether you’re managing a directional view or mitigating risk, Delta tells you where you stand. The real question is: How are you using Delta to stay ahead of the game?

Comments